The main VAT rate in Estonia is 20%, but there are exceptions. For example, books, magazines, accommodation and certain medicines are currently subject to a 9% VAT rate. You can find more detailed information on VAT rates on the website of the Tax and Customs Board.

Does Shopify support different VAT rates?

The simple answer is yes it supports, but the configuration is not based on a single product, but on a collection.

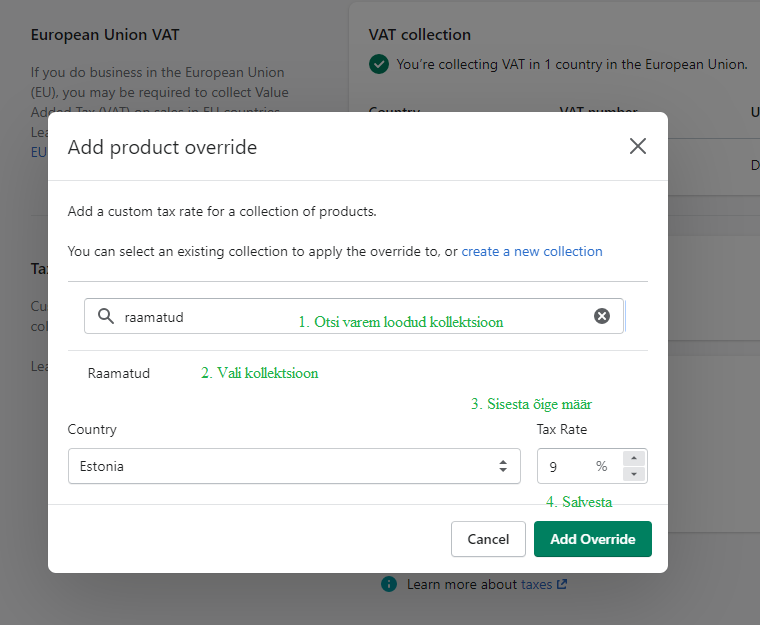

To set up different VAT options, you’ll need to follow a few simple steps:

- Create a new collection for products that must have a 9% VAT rate. This collection does not have to be visible in the e-shop if you do not want it.

- Add all products to the created collection, the VAT rate of which will be 9%.

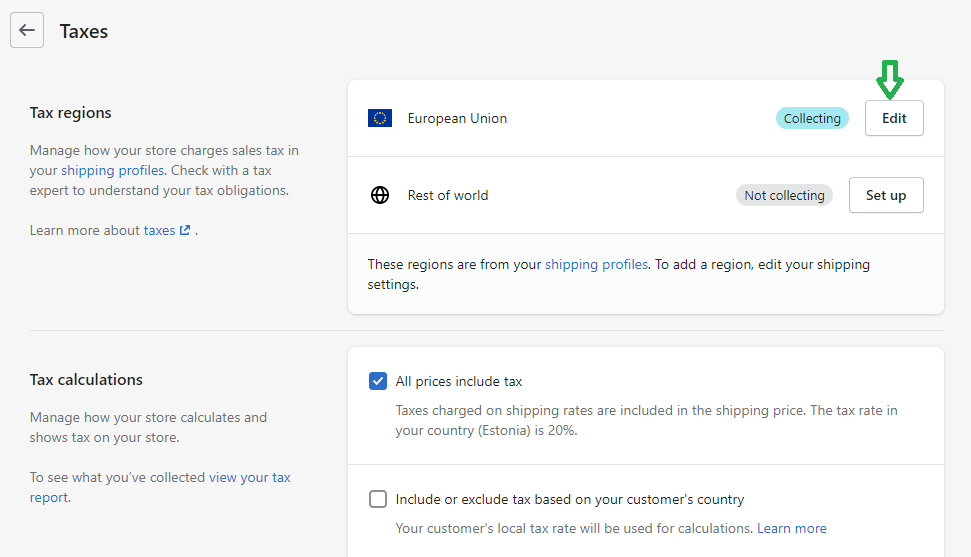

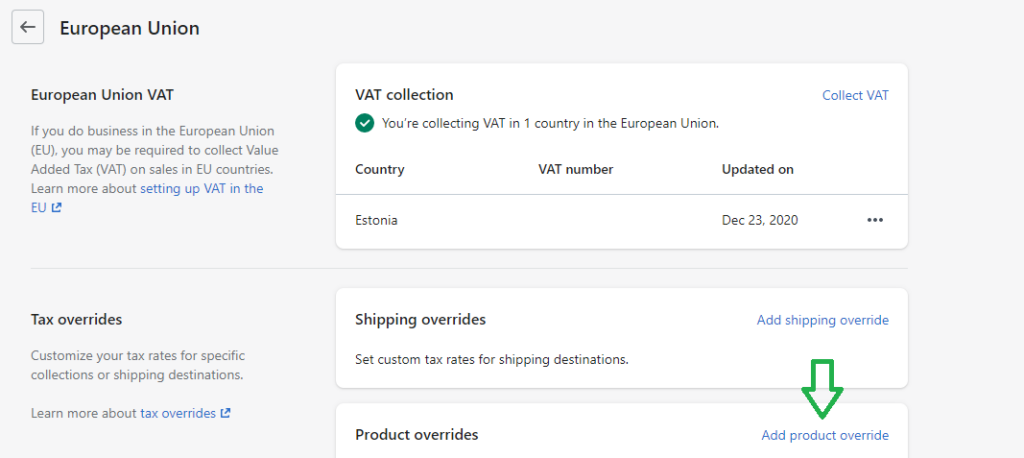

- Go to the e-shop admin Settings⇒Taxes and select the country (or the whole EU) and click the Edit button.

- Next steps are on the pictures ⇓

This way all products in the selected collection will have 9% VAT.

0 0 votes

Article Rating

Subscribe

0 Comments

Oldest

Newest Most Voted

Inline Feedbacks

View all comments